stamp duty on contract agreement malaysia

Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. The 24 hours central monitoring system and 24 hours armed response team will assured you with our 3-tiers security systems to prevent and minimize the possibilities of loss of secretarial.

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

A full stamp duty exemption is given on.

. Stamp Duty is payable in full and is to be paid on the deadline. Article 5hAiv of the Schedule 1 states the Stamp duty on the agreement or memorandum of agreement that creates any obligation right or interest and creates a monetary value. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. RM 310 for account without guarantor. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption.

Stamp duties are payable pursuant to Section 3 of the Indian Stamp Act 1899. It is a tax paid to the government similar to the income tax. Also read all about income tax provisions for TDS on rent.

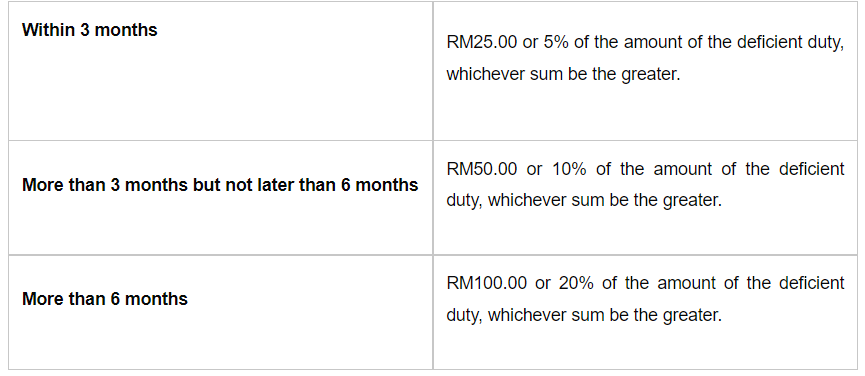

During the rental period participants pay rent usually above the market average as well as an ongoing fee for the option to buy the property at the end of the contract. If payment of the stamp duty is delayed it will incur a fine. How transfer for debts stocks securities future payment and further consideration to be charged 18.

The law on stamping and registration. Must contain at least 4 different symbols. Get a solicitor or conveyancer to look over the contract.

If the amount exceeds rupees ten lakh the rate. They do this by sending a valuer who will inspect the home and compare it to similar properties on the market. Stamp duty on lease agreements.

Relief from stamp duty in case of transfer of property between associated companies 16. Read latest breaking news updates and headlines. RM1000 per agreement for stamp duty.

Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400. Where the Contract or Agreement is executed signed overseas BSD and ABSD must be paid within 30 days after the receipt of the Contract or Agreement in Singapore. Stamp duty on rental agreements.

The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagionHowever the recovery in 19981999 was rapid and worries of a meltdown subsided. Individuality or self-hood is the state or quality of being an individual. A document is considered to be duly stamped only when stamp duty is fully paid.

RM 2000 per agreement for documentation and stamp duty. ASCII characters only characters found on a standard US keyboard. RM 620 for account with 1 guarantor.

500- whichever is lower. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400. Stamp duty in India is governed by two legislations ie a stamp Act legislated by the Parliament and a stamp Act legislated by the state legislature.

Prepare a list of requirements for your ideal room. The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899.

According to the Registration Act 1908 the registration of a lease agreement is mandatory if. Some rent-to-buy contracts also require the participant to cover additional outgoings such as building maintenance stamp duty and insurance. If the bank feels the agreed-upon amount is too much they may want to renegotiate the agreement.

Shortlist and negotiate the monthly rent Step 3. Having a conveyancer or solicitor on hand to read over contracts is a must. 6 to 30 characters long.

Generally the stamp duty is paid by the buyer in some cases the buyer and seller decide to split the stamp duty as per an earlier signed agreement. Latest news expert advice and information on money. BSD and ABSD must be paid within 14 days after the date of the signed Contract or Agreement.

Sign the Tenancy Agreement Step 5. If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us. And if the Tenancy Agreement has been signed for more than 3 years the.

Stamp duty is the governments charge levied on different property transactions. So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price.

RM 1000 per agreement for stamp duty. Particularly in the case of humans of being a person unique from other people and possessing ones own needs or goals rights and responsibilitiesThe concept of an individual features in diverse fields including biology law and philosophy. Get information on latest national and international events more.

Pensions property and more. Variation on HP Agreement upon request. The crisis started in Thailand known in Thailand as the Tom Yam Kung crisis.

An individual is that which exists as a distinct entity. Accordingly use the filters on PropertyGuru and narrow down the choices. Submit a Letter of Intent LOI to the landlord Step 4.

RM 930 for account with 2 guarantors. Most rent agreements are signed for 11 months so that they can avoid stamp duty and other charges. Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity.

Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia. Stamp duty is 1 of the total rent plus deposit paid annually or Rs. Relief from stamp duty in case of reconstructions or amalgamations of companies 15A.

First-time homebuyers will get a stamp duty exemption on the instrument of transfer and loan agreement under the Keluarga Malaysia Home Ownership Initiative i-MILIKI says Datuk. Pay the Rental Stamp Duty and move in. Our office in Malaysia utilizes outsourced reputable security system on top of the building security control in-and-out gate and the building security guards.

Voluntary conveyance inter vivos 17. Get 247 customer support help when you place a homework help service order with us.

Stamp Duty Administration And Legal Fees For A Tenancy Agreement In Malaysia Iproperty Com My

Stamp Duty Legal Fees New Property Board

Malaysian Tax Law Stamp Duty Lexology

Stamp Duty Malaysia For Contract Agreement Calculator Jordyndsx

Stamping A Contract Is An Unstamped Contract Valid

Contactless Rental Stamp Duty Tenancy Agreement Runner Service

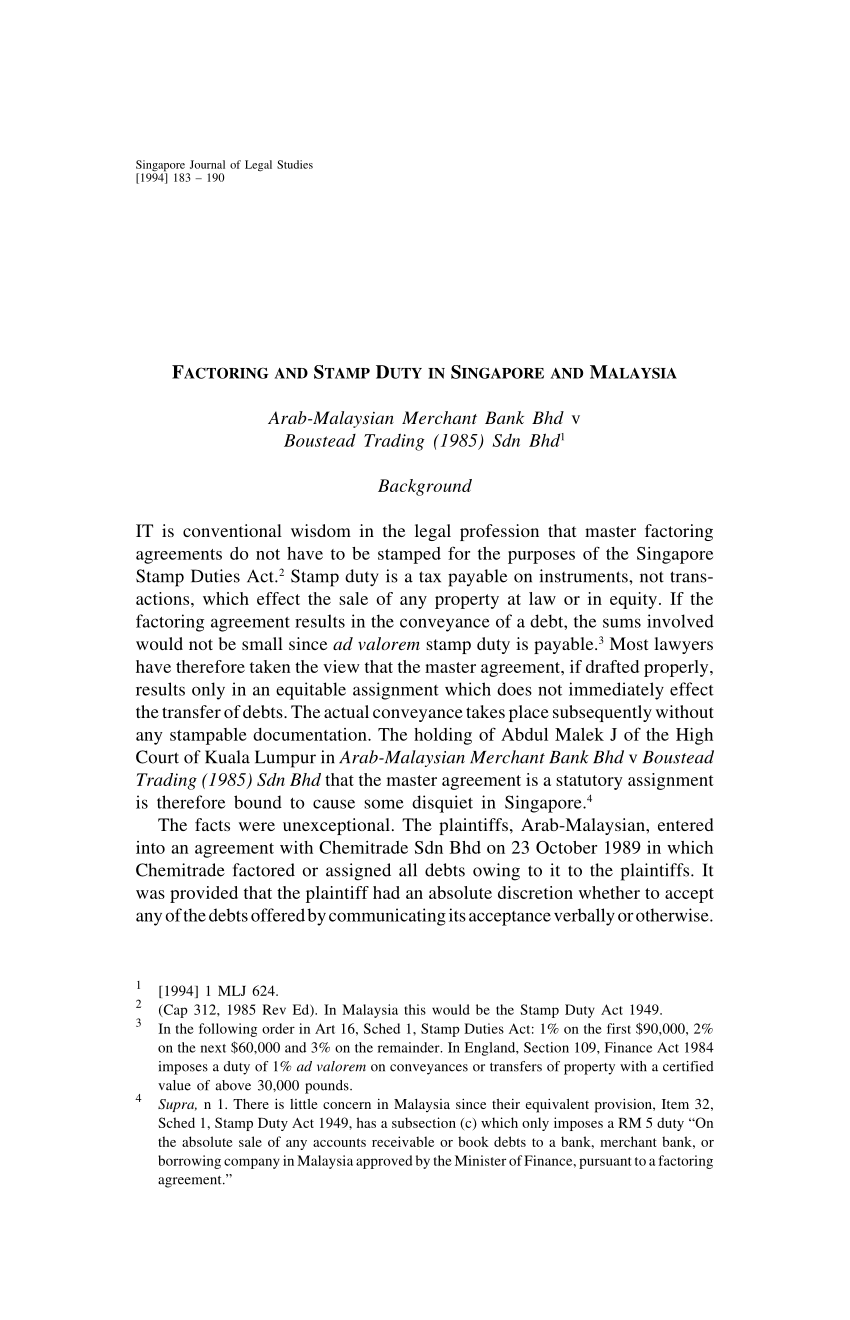

Pdf Factoring And Stamp Duty In Singapore And Malaysia

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Stamp Duty And Contracts Yee Partners

Govt To Reinstate Stamp Duty Cap For Share Transactions At Rm1 000 Per Contract Note Maintain Higher Rate Of 0 15 Source The Edge Markets

How To Write Your Own Tenancy Agreement In Malaysia Recommend My

Contoh Tenancy Agreement Malaysia Arif Hussin

Real Property Gains Tax Rpgt In Malaysia 2022

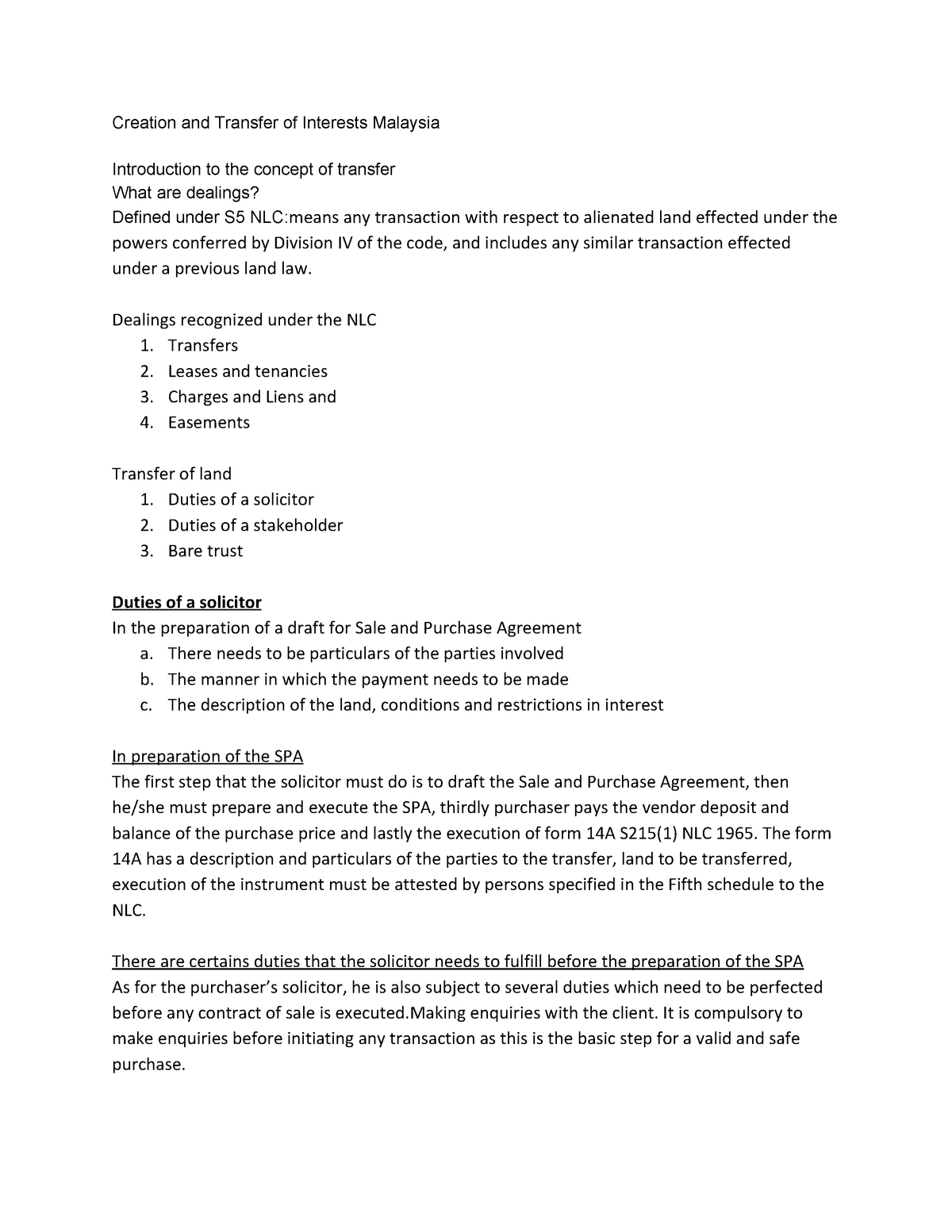

Land Law 3 Topic 1 Creation And Transfer Of Interests Malaysia Introduction To The Concept Of Studocu

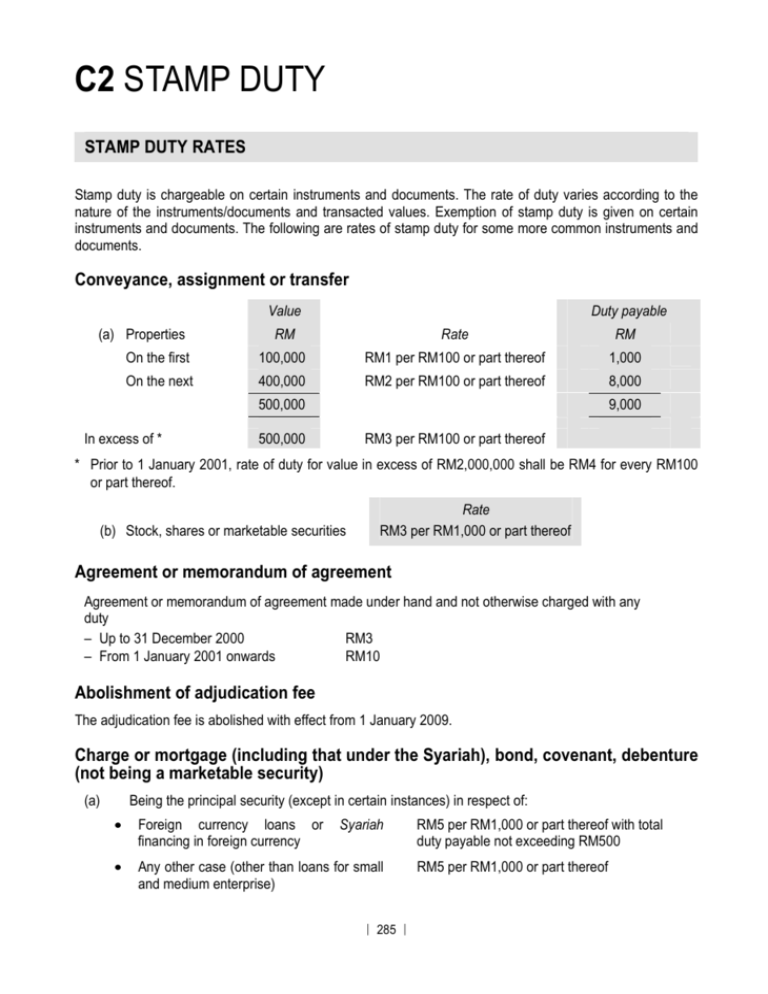

C2 Stamp Duty The Malaysian Institute Of Certified Public

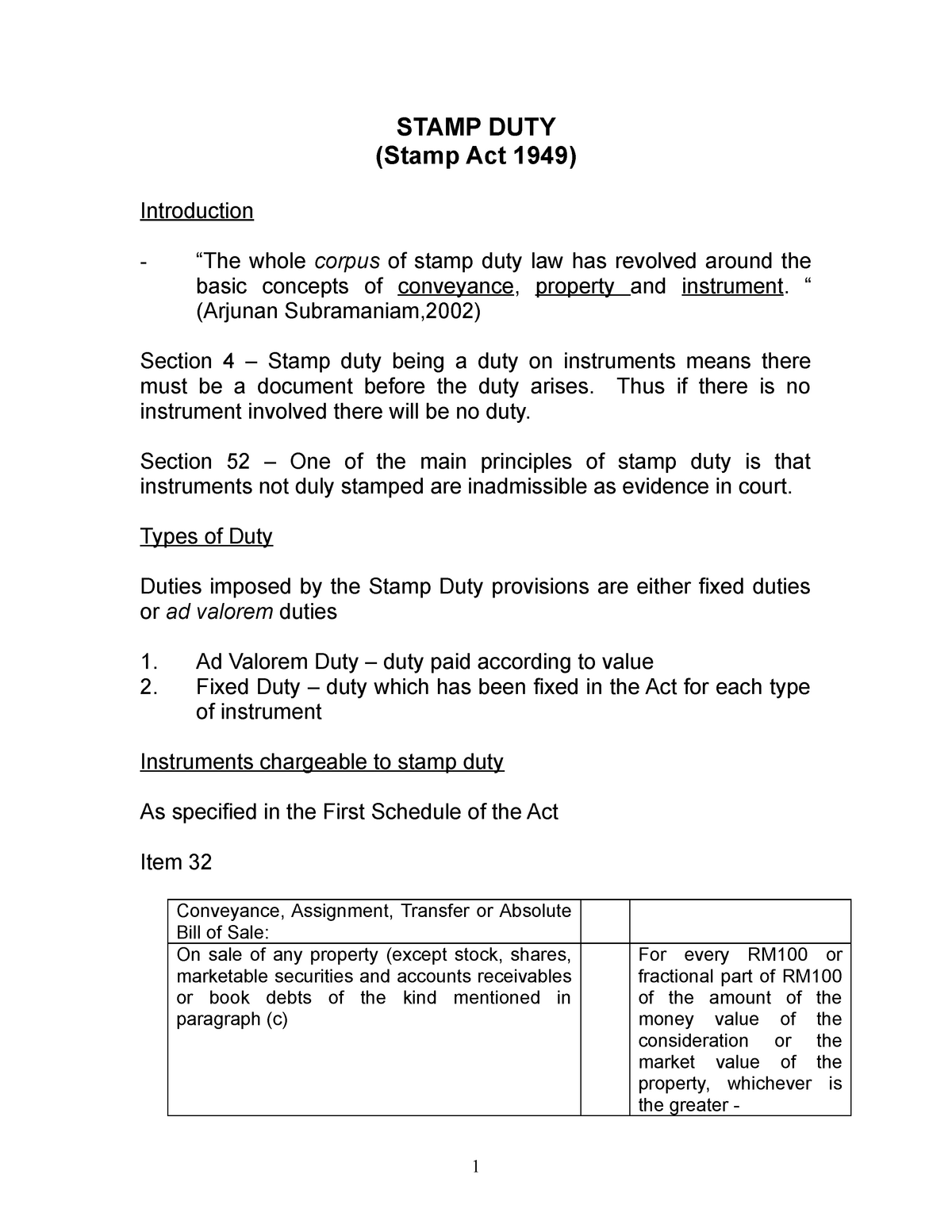

Stamp Duty Notes Statutory Valuation For Auction Rating Wayleave Easement Stamp Duty Stamp Studocu

Comments

Post a Comment